UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

Filed by the Registrant [X] |

Filed by a party other than the Registrant [ ] |

|

Check the appropriate box: |

|

[ ]x | | Preliminary Proxy Statement |

[ ]o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X]o | | Definitive Proxy Statement |

[ ]o | | Definitive Additional Materials |

[ ]o | | Soliciting Material under §240.14a-12 |

| KIMCO REALTY CORPORATION | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| | |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check all boxes that apply):

Payment of Filing Fee (Check all boxes that apply): |

[X]x | | No fee required |

[ ]

o | | Fee paid previously with preliminary materials |

[ ]

o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of ContentsAnnual Meeting of Stockholders

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

We cordially invite you to attend the 2022 annual stockholders’ meeting of Kimco Realty Corporation, a Maryland corporation (the “Company”).Corporation

Annual Meeting Proposals

date:1. Election of eight directors to serve until the 2025 annual meeting of stockholders and until their successors are duly elected and qualify | | April 26, 2022See page 11 |

time:2. Advisory resolution to approve the Company’s executive compensation (“Say-on-Pay”) as described in the Proxy Statement | | See page 22 |

| 3. Approval of an amendment to the charter of the Company to increase the number of authorized shares of stock | | See page 45 |

| 4. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 | | See page 48 |

| 5. The transaction of any other business that may properly come before the meeting or any postponement(s) or adjournment(s) thereof | | |

Logistics

| Date: | May 7, 2024 |

| Time: | 10:00 a.m. (Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time). |

place:Place: | | Online only at: www.virtualshareholdermeeting.com/KIM2024 |

| Record Date: | | www.virtualshareholdermeeting.com/KIM2022 |

record date: | | The close of business on March 1, 202212, 2024 |

At the 2022 annual meeting, stockholders as of the close of business on the record date will be asked to consider and vote upon the following matters, as more fully described in the Proxy Statement:

| 1 | | 2 | | 3 | | 4 |

| Election of eight directors to serve for a term ending at the 2023 annual meeting of stockholders and until their successors are duly elected and qualify | | Advisory resolution to approve the Company’s executive compensation (“Say-on-Pay”) as described in the Proxy Statement | | Ratification of the appointment of Pricewaterhouse Coopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 | | Such other business as may properly come before the meeting or any postponement(s) or adjournment(s) thereof |

All stockholders are cordially invitedIf you plan to attend the 2022 annual meeting, which2024 Annual Meeting of Stockholders (the “Annual Meeting”) online, you will be conducted via a live webcast. The Company is excited to again embraceneed the environmentally-friendly virtual meeting format, which it believes will enable increased stockholder attendance and participation. 16-digit control number included in your Notice of Internet Availability of Proxy Materials on your proxy card or on the instructions that accompany your proxy materials.

During this virtual meeting, you may ask questions, and you will be able to vote your shares electronically. You may also submit questions in advance of the 2022 annual meeting by visiting www.virtualshareholdermeeting.com/KIM2022.KIM2024. The Company will respond to as many inquiries at the 2022 annual meeting as time allows.

How to Vote or Authorize Your Proxy

| By Internet: | www.proxyvote.com |

| By Telephone: | 1-800-690-6903 |

| By Mail: | Complete your proxy card and cast your vote by pre-paid mail |

Beneficial Owners:

If you own shares registered in the name of a broker, bank or other nominee, please follow the instructions they provide on how to vote your shares.

Proxy Voting:

Please submit your proxy or voting instructions as soon as possible to instruct how your shares are to be voted at the Annual Meeting, even if you plan to attend the 2022 annual meeting online,Annual Meeting. If you later vote at the Annual Meeting, your previously submitted proxy or voting instructions will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The 2022 annual meeting will begin promptly at 10:00 a.m. (Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures.not be used.

YOUR VOTE IS IMPORTANT TO US.Whether or not you plan to attend the 2022 annual meeting,Annual Meeting, please authorize a proxy to vote your shares as soon as possible to ensure that your shares will be represented at the 2022 annual meeting.Annual Meeting.

By OrderOn behalf of the Board of Directors

Bruce M. Rubenstein

Executive Vice President, General Counsel and Secretary

March 16, 202225, 2024

Important Notice Regarding Internet Availability of Proxy Materials

We are pleased to take advantage of the Securities and Exchange Commission (“SEC”) rules allowing companies to furnish proxy materials to their stockholders over the Internet. We believe that this e-proxy process will expedite stockholders’ receipt of proxy materials, lower the costs, and reduce the environmental impact of our 2022 annual meeting.Annual Meeting. We will send a full set of proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) on or about March 16, 202225, 2024 and provide access to our proxy materials over the Internet, beginning on March 16, 2022,25, 2024, for the holders of record and beneficial owners of our Common Stockcommon stock as of the close of business on the record date. The Notice of Internet Availability instructs you on how to access and review the Proxy Statementproxy statement and our annual report. The Notice of Internet Availability also instructs you on how you may authorize a proxy to vote your shares over the Internet.

| kimcorealty.com | 2024 Proxy Statement | | i |

Safe Harbor Statement

This proxy statement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with the safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,” “project,” “will,” “target,” “plan,” “forecast” or similar expressions. You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which, in some cases, are beyond the Company’s control and could materially affect actual results, performances or achievements. Factors which may cause actual results to differ materially from current expectations include, but are not limited to, (i) general adverse economic and local real estate conditions, (ii) the impact of competition, including the availability of acquisition or development opportunities and the costs associated with purchasing and maintaining assets; (iii) the inability of major tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business, (iv) the reduction in the Company’s income in the event of multiple lease terminations by tenants or a failure of multiple tenants to occupy their premises in a shopping center, (v) the potential impact of e-commerce and other changes in consumer buying practices, and changing trends in the retail industry and perceptions by retailers or shoppers, including safety and convenience, (vi) the availability of suitable acquisition, disposition, development and redevelopment opportunities, and the costs associated with purchasing and maintaining assets and risks related to acquisitions not performing in accordance with our expectations, (vii) the Company’s ability to raise capital by selling its assets, (viii) disruptions and increases in operating costs due to inflation and supply chain disruptions, (ix) risks associated with the development of mixed-use commercial properties, including risks associated with the development, and ownership of non-retail real estate, (x) changes in governmental laws and regulations, including, but not limited to, changes in data privacy, environmental (including climate change), safety and health laws, and management’s ability to estimate the impact of such changes, (xi) the Company’s failure to realize the expected benefits of the merger with RPT Realty (“RPT Merger”), (xii) significant transaction costs and/or unknown or inestimable liabilities related to the RPT Merger, (xiii) the risk of litigation, including shareholder litigation, in connection with the RPT Merger, including any resulting expense, (xiv) the ability to successfully integrate the operations of the Company and RPT and the risk that such integration may be more difficult, time-consuming or costly than expected, (xv) risks related to future opportunities and plans for the combined company, including the uncertainty of expected future financial performance and results of the combined company, (xvi) effects relating to the RPT Merger on relationships with tenants, employees, joint venture partners and third parties, (xvii) the possibility that, if the Company does not achieve the perceived benefits of the RPT Merger as rapidly or to the extent anticipated by financial analysts or investors, the market price of the Company’s common stock could decline, (xviii) valuation and risks related to the Company’s joint venture and preferred equity investments and other investments, (xix) valuation of marketable securities, (xx) impairment charges, (xxi) criminal cybersecurity attacks, disruption, data loss or other security incidents and breaches, (xxii) risks related to artificial intelligence, (xxiii) impact of natural disasters and weather and climate-related events, (xxiv) pandemics or other health crises, such as coronavirus disease 2019 (“COVID-19”), (xxv) our ability to attract, retain and motivate key personnel, (xxvi) financing risks, such as the inability to obtain equity, debt or other sources of financing or refinancing on favorable terms to the Company, (xxvii) the level and volatility of interest rates and management’s ability to estimate the impact thereof, (xxviii) changes in the dividend policy for the Company’s common and preferred stock and the Company’s ability to pay dividends at current levels, (xxix) unanticipated changes in the Company’s intention or ability to prepay certain debt prior to maturity and/ or hold certain securities until maturity, (xxx) the Company’s ability to continue to maintain its status as a REIT for U.S. federal income tax purposes and potential risks and uncertainties in connection with its UPREIT structure, and (xxxi) other risks and uncertainties identified under Item 1A, “Risk Factors” and elsewhere in our most recent Annual Report on Form 10-K and in the Company’s other filings with the Securities and Exchange Commission (“SEC”). Accordingly, there is no assurance that the Company’s expectations will be realized. The Company disclaims any intention or obligation to update the forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to refer to any further disclosures the Company makes or related subjects in the Company’s quarterly reports on Form 10-Q and current reports on Form 8-K that the Company files with the SEC. Certain forward-looking and other statements in this proxy statement, or other locations, such as our corporate website, contain various environmental, social, and governance (“ESG”) standards and frameworks (including standards for the measurement of underlying data) and the interests of various stakeholders. As such, such information may not, and should not be interpreted as necessarily being, “material” under the federal securities laws for SEC reporting purposes, even if we use the word “material” or “materiality” in this document. ESG information is also often reliant on third-party information or methodologies that are subject to evolving expectations and best practices, and our approach to and discussion of these matters may continue to evolve as well. For example, our disclosures may change due to revisions in framework requirements, availability of information, changes in our business or applicable governmental policies, or other factors, some of which may be beyond our control.

500 North Broadway, Suite 201

Jericho, NY 11753-2128ii |  | Kimco Realty | kimcorealty.com |

Table of Contents

| kimcorealty.com | 2024 Proxy Statement | | iii |

This page is intentionally left blank.

About Kimco

Kimco Realty® (NYSE: KIM) is a real estate investment trust (REIT) headquartered in Jericho, N.Y. that is North America’s largest publicly traded owner and operator of open-air, grocery-anchored shopping centers and a growing portfolio of mixed-use assets. The company’s portfolio is primarily concentrated in the first-ring suburbs of the top major metropolitan markets, including those in high-barrier-to-entry coastal markets and rapidly expanding Sun Belt cities, with a tenant mix focused on essential, necessity-based goods and services that drive multiple shopping trips per week. Kimco Realty is also committed to leadership in environmental, social and governance (ESG) issues and is a recognized industry leader in these areas. Publicly traded on the NYSE since 1991 and included in the S&P 500 Index, the company has specialized in shopping center ownership, management, acquisitions, and value enhancing redevelopment activities for more than 60 years. As of December 31, 2023, the company owned interests in 523 U.S. shopping centers and mixed-use assets comprising 90 million square feet (“SF”) of gross leasable space. On January 2, 2024, Kimco Realty closed the acquisition of RPT Realty, which added 56 open-air shopping centers, comprising 13.3 million square feet of gross leasable area, to Kimco’s portfolio.

| | TABLE OF CONTENTS | | |

Company Information

Established in 1958

Member of the S&P 500

Listed on NYSE

| Our Properties*

523 properties

90 million SF of gross leasable area | Our Employees*

660 employees

27 primary offices

Average tenure of 9.4 years |

| | |

* As of 12/31/2023

| kimcorealty.com | 2024 Proxy Statement | | 1 |

Operating Performance Highlights

Kimco’s operating results in 2023 reflect the success of our strategy, focused on grocery-anchored, open-air and mixed-use centers in the first ring suburbs of the top major metropolitan markets in the U.S.

| | | | |

| Balance Sheet

& Liquidity Strength | |  | Operational

Resilience |

• Ended the year with $2.8 billion of immediate liquidity. • Reported Consolidated Net Debt-to-EBITDA* of 5.6x. • Maintained S&P and Moody’s investment grade unsecured debt ratings of BBB+ and Baa1, respectively. | | • Operationally, we reached new heights in square footage leased at 12 million square feet across 2,000 leases signed during the year. • Grew pro-rata portfolio occupancy 50 basis points to 96.2%. • Ended the year with pro-rata occupancy for anchor spaces at 98.0%, and pro-rata small shop at an all-time high of 91.7%. • Expanded the spread between leased (reported) occupancy versus economic occupancy to 350 basis points, representing approximately $57 million in future annual base rent. |

| | | | | |

| Dividend Growth &

Cash Flow | |  | Investment Activity

& Capital Recycling |

• Generated over $1.1 billion in net cash flow provided by operating activities and paid an aggregate of $657.5 million of dividends. • Raised the quarterly dividend on common shares payable in March 2024 to $0.24 per share, an increase of 4.3% over the quarterly dividend in the corresponding period of the prior year. • Paid a $0.09 per share special dividend as a result of Kimco receiving a $194.1 million special dividend payment from Albertsons Companies, Inc. (NYSE: ACI). | | • Acquired Stonebridge at Potomac Town Center, a 96%-occupied, dominant grocery-anchored property for $172.5 million. Also, announced the $2.2 billion acquisition of RPT Realty, that closed in January 2024. • Realized net proceeds of $282.3 million from the sale of 14.1 million shares of ACI common stock. Ended the year with 14.2 million shares of ACI common stock which were sold in February 2024 for $299.1 million. |

| | 2022 PROXY STATEMENT AT A GLANCE | |

Total Return Performance Indexed to 100

*Reconciliations of non-GAAP measures to the most directly comparable GAAP measure are provided in Annex A

| 2 | | Kimco Realty | kimcorealty.com |

Leaders in Corporate Responsibility

The Company strives to build a thriving and viable business, one that succeeds by delivering long-term value for our stockholders. We believe that the Company’s ESG program is aligned with its core business strategy of creating destinations for everyday living that inspire a sense of community and deliver value to our many stakeholders.

ESG Oversight

The Nominating and Corporate Governance Committee of the Company’s Board of Directors (“Board” or “Board of Directors”) is responsible for reviewing and monitoring (i) the development and implementation of goals established for the ESG program, (ii) the development of metrics to gauge progress toward the achievement of those goals, and (iii) the Company’s progress against those goals. The Company’s Chief Executive Officer (“CEO”), Conor Flynn, who is a director, is the executive sponsor for the Company’s ESG program with oversight over ESG topics including climate and, diversity, equity, and inclusion (“DEI”). All Kimco named executive officers and corporate officers have ESG performance metrics, including certain climate metrics, tied into their compensation plans.

The Company’s management-level ESG Steering Committee is responsible for regularly reviewing and recommending strategic priorities and goals to management, as well as reporting to the Board quarterly. These updates include Board continuing education sessions on ESG topics. This ESG Steering Committee is cross-functional and diverse, comprised of both named executive officers and departmental and regional executives across multiple dimensions of the Company, including representation from the ESG Department. Subcommittees of the ESG Steering Committee include the Communications Subcommittee focused on cross-stakeholder communications, and the ESG Capital Improvements Subcommittee focused on capital improvement planning to help the Company achieve its Science-Based climate target and other ESG goals.

Led by the Vice President of ESG, the Company’s ESG Department includes staff dedicated to driving key ESG strategies, programs, and initiatives across the organization. Additionally, the Company’s ESG Governance structure allows for employee feedback and programming via the employee driven KIMunity Councils.

Select Program Highlights

| • | Allocated an additional $17.3 million towards the Company’s green bond, with $373.8 million total allocated as of June 30, 2023. |

| • | Amended and restated its $2 billion unsecured revolving credit facility with enhanced sustainability matrix tied to GHG emission reduction strategy, with applicable margin adjustments (up to +/- four basis points) tied to the Company’s performance towards Scope 1 and 2 Science-Based Target. |

| • | Launched Institute of Real Estate Management® (IREM) Certified Sustainable Properties Certification Volume Program and certified 19 properties. |

| • | Implemented a bundled renewable energy credit (REC) procurement pilot, supplementing operational efficiency enhancements, to support the Company’s pathway to net zero. |

| • | Continued implementation of employee resource groups (ERGs) and annual volunteerism drive to support and advance employee engagement and inclusion. |

| • | Regularly engaged on ESG topics and projects with stakeholders including Board, leadership, employees, stockholders and joint venture partners, tenants and retailer partners, and vendors and communities. |

Select Awards/Recognition

| • | Awarded the 2023 Nareit® Leader in the Light Award for outstanding ESG practices within the retail REIT sector. |

| • | Recognized by GRESB (formerly known as the Global Real Estate Sustainability Benchmark), earning the distinguished Green Star designation for the tenth consecutive year, placing first in our peer group (U.S. Retail: Retail Centers), and achieving an “A” Public Disclosure Rating. |

| • | Included in the Dow Jones® Sustainability North America Index (DJSI) for the ninth consecutive year. |

| • | Included in the Russel FTSE4Good® Index Series for the fifth consecutive year. |

| • | Achieved “Prime” status on 2023 ISS ESG Corporate Rating Report. |

| • | Received the top score of 100 for the Human Rights Campaign Foundation’s Corporate Equality Index, designated as a recipient of the Equality 100 Award: Leader in LGBTQ+ Workplace Inclusion. |

| • | Awarded the Great Place to Work® Certification for the sixth consecutive year. |

| • | Named one of the 2023 Best Workplaces in Real EstateTM by Great Place to Work®. |

| kimcorealty.com | 2024 Proxy Statement | | 3 |

ESG Disclosure Roadmap

The Company is committed to excellence in ESG disclosure and has aligned its annual reporting toward standards from the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD). The Company also discloses aggregate-level EEO-1 workforce data that can be found on the Company’s website, which data and website contents are not incorporated by reference and do not form a part of this Proxy Statement. ESG information of relevance to stakeholders, including program governance, goals and performance, can be found in three primary locations:

| | | | | | | |

| Annual Report/ 10-K Summarizes ESG program priorities and material risk disclosures. | |  | Proxy Statement Summarizes corporate governance practices, including how the Board and management are engaged in ESG program strategy, governance and accountability. | |  | Corporate Responsibility Report Based on the Global Reporting Initiative (GRI) standard, summarizes environmental and social performance. |

| | | | | | | |

The information contained in our EEO-1 Report, Annual Report/10-K and Corporate Responsibility Report does not constitute part of this Proxy Statement. Additional ESG information of interest to stakeholders can be found on the Company’s website, the contents of which are not incorporated by reference and do not form a part of this Proxy Statement.

| 4 | | Kimco Realty | kimcorealty.com |

Governance at Kimco

Corporate Governance Policies and Procedures Overview

The Board is responsible for providing governance and oversight of the strategy, operations and management of the Company with its primary objective being to represent the interests of our stockholders. The Board oversees our senior management to whom it has delegated the authority to manage the day-to-day operations of the Company. The Board has adopted Corporate Governance Guidelines, committee charters, and a Code of Conduct that, together with our Charter and Bylaws, form the governance framework for the Board and its committees.

The Board regularly reviews the Corporate Governance Guidelines and other corporate governance documents and, from time to time, revises them when it believes it is in the best interests of the Company and our stockholders to do so given changing regulatory and governmental requirements and best practices. The following sections provide an overview of our corporate governance structure.

Complete copies of our Corporate Governance Guidelines, committee charters, Code of Conduct and other governance documents are available in the Investor/Governance section of our website at www.kimcorealty.com.

Highlights

Board Structure and Independence |  Separate Chairman and CEO Separate Chairman and CEO

Lead Independent Director, who is elected by the independent directors Lead Independent Director, who is elected by the independent directors

6 of 8 directors are independent; Audit, Executive Compensation and Nominating and Corporate Governance Committees are each entirely comprised of independent directors 6 of 8 directors are independent; Audit, Executive Compensation and Nominating and Corporate Governance Committees are each entirely comprised of independent directors

Require any search firm to include in its initial list of board candidates, qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin, gender, and sexual orientation Require any search firm to include in its initial list of board candidates, qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin, gender, and sexual orientation

Executive sessions of non-management directors held at all board and committee meetings Executive sessions of non-management directors held at all board and committee meetings

Annual offsite strategic review by the Board with management Annual offsite strategic review by the Board with management

Diverse Board with two female directors and two ethnically and/or racially diverse members Diverse Board with two female directors and two ethnically and/or racially diverse members

No familial relationships among Board members No familial relationships among Board members

Limits on other board service to prevent “overboarding” Limits on other board service to prevent “overboarding”

Formal “Clawback” Policy Formal “Clawback” Policy

|

| |

Stockholder Rights | DIRECTOR INDEPENDENCE Annual election of all directors Annual election of all directors

Majority voting for directors in uncontested elections Majority voting for directors in uncontested elections

No supermajority vote requirements No supermajority vote requirements

Annual Say-on-Pay advisory vote Annual Say-on-Pay advisory vote

Stockholders have the right to amend the Bylaws Stockholders have the right to amend the Bylaws

Stockholders representing a majority can call special meeting Stockholders representing a majority can call special meeting

Proxy Access: stockholder (or a group of 20) owning 3% of our common stock for at least three years may nominate up to 20% of board members Proxy Access: stockholder (or a group of 20) owning 3% of our common stock for at least three years may nominate up to 20% of board members

No “poison pill” in effect No “poison pill” in effect

“Double trigger” change in control arrangement that covers certain of our named executive officers (“NEOs”)* “Double trigger” change in control arrangement that covers certain of our named executive officers (“NEOs”)*

Feedback solicited from stockholders is shared with our Board Feedback solicited from stockholders is shared with our Board

|

23 | |

Board Oversight | CORPORATE GOVERNANCE Structured oversight of the Company’s corporate strategy and risk management Structured oversight of the Company’s corporate strategy and risk management

ESG strategy and initiatives, as well as corporate governance oversight by Nominating and Corporate Governance Committee ESG strategy and initiatives, as well as corporate governance oversight by Nominating and Corporate Governance Committee

Provide continuing education for our Board Provide continuing education for our Board

Cybersecurity and regulatory compliance oversight by Audit Committee Cybersecurity and regulatory compliance oversight by Audit Committee

Board and senior management succession planning Board and senior management succession planning

Annual self-assessment of Board and Board committee performance Annual self-assessment of Board and Board committee performance

|

24 | |

Accountability and Best-In-Class Governance Practices | COMMITTEES OF THE BOARD OF DIRECTORS | 25 |  Met or spoke with stockholders representing 64% of our common stock in 2023 Met or spoke with stockholders representing 64% of our common stock in 2023

Stock ownership policy for directors and NEOs and stock retention requirement for directors and NEOs who have not achieved the applicable stock ownership level Stock ownership policy for directors and NEOs and stock retention requirement for directors and NEOs who have not achieved the applicable stock ownership level

Prohibition of hedging and pledging Company stock by directors and NEOs Prohibition of hedging and pledging Company stock by directors and NEOs

Code of Conduct for directors, officers and employees Code of Conduct for directors, officers and employees

ESG Steering Committee to manage ESG program ESG Steering Committee to manage ESG program

Oversight of political contributions (de minimis amounts in 2023) Oversight of political contributions (de minimis amounts in 2023)

|

| | EXECUTIVE OFFICERS |

*See Executive Compensation Highlights on page 23 for What We Do and What We Do Not Do

| kimcorealty.com | 282024 Proxy Statement | | 5 |

Table of Contents

2022 PROXY STATEMENT AT A GLANCE

The following executive summary is intended to provide a broad overview of the items that you will find elsewhere in this Proxy Statement. As this is only a summary, we encourage you to read the entire Proxy Statement for more information about these topics prior to voting.

Board Leadership Structure

The Board of Directors has separated the roles of the Executive Chairman of the Board of Directors and the CEO in recognition of the differences between the two roles. The CEO is responsible for setting our strategic direction and the day-to-day leadership and performance of the Company, while the Executive Chairman of the Board of Directors provides guidance to the CEO, establishes the agenda for Board of Directors meetings in consultation with the CEO and Lead Independent Director and presides over meetings of the full Board of Directors. Because Mr. Cooper, the Executive Chairman, is an employee of the Company and is, therefore, not “independent,” the Board of Directors elected Mary Hogan Preusse, as Lead Independent Director to preside at all executive sessions of “non-management” directors, as defined under the NYSE Listed Company Manual.

Lead Independent Director The Lead Independent Director is elected by the other independent directors and presides at all meetings of the Board of Directors at which the Executive Chairman is not present, including executive sessions of the non-management directors, which typically occur after each Board meeting. The Lead Independent Director encourages and facilitates active participation of all directors and serves as a liaison between management and the other independent directors. The Lead Independent Director also has the authority to call meetings of the independent directors, monitors and coordinates with management and the Nominating and Corporate Governance Committee on ESG issues and developments, and approves meeting agendas and the information sent to the Board of Directors, including the quality, quantity and timeliness of such information. | | BOARD’S VOTING

RECOMMENDATION | | PAGE REFERENCES

(for more detail)Mary Hogan Preusse

Lead Independent Director |

date: | | April 26, 2022 | | Election• Lead Independent Director since 2020 • Chair of Directors | | FOR EACH NOMINEE | | 18 |

time: | | 10:00 a.m. (Eastern time) | | Advisory Resolution to Approve Executive Compensation | | FOR | | 54 |

place: | | Online only at:

www.virtualshareholdermeeting.com/KIM2022 |

record date: | | The close of business

on March 1, 2022 | | Ratification of Independent Accountants | | FOR | | 56Nominating & Corporate Governance Committee• Extensive experience in public company governance, the REIT industry and real estate management |

PARTICIPATE IN THE ANNUAL MEETINGDirector Independence

DueOur Board of Directors has adopted a formal set of categorical independence standards for directors. These categorical standards specify the criteria by which the independence of our directors will be determined, including guidelines for directors and their immediate families with respect to the potential travel and community gathering impacts of COVID-19,past employment or affiliation with the Company will again be utilizing an online format foror its independent registered public accounting firm. These categorical standards meet, and in some areas exceed, the 2022 annual meeting. You can accesslisting standards of the virtual annual meetingNYSE. The Board of Directors’ categorical standards are available along with our Corporate Governance Guidelines on the Company’s website in the Investor/Governance section at www.virtualshareholdermeeting.com/KIM2022. By hostingwww.kimcorealty.comand are available in print to any stockholder who requests them. The Board of Directors affirmatively determined that the 2022 annual meeting online, the Company is able to communicate more effectively with its stockholders, enable increased attendance and participation from locations around the world, reduce costs and increase overall safety for bothfollowing directors are independent of the Company and its stockholders. This approach also aligns withmanagement under the Company’s broader sustainability goals. The virtual meeting has been designed to providestandards set forth in the same rights to participate as you would havecategorical standards and the NYSE listing standards: Philip E. Coviello, Frank Lourenso, Henry Moniz, Mary Hogan Preusse, Valerie Richardson and Richard B. Saltzman.

Term Of Office

All directors of the Company elected at an in-person meeting.

If you plan to attend the 2022 annual meeting online, you2024 Annual Meeting of Stockholders (the “Meeting”) will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The 2022 annual meeting will begin promptly at 10:00 a.m. (Eastern Time). Online check-in will begin at 9:30 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures.

4 | Kimco Realty Corporation 2022 PROXY STATEMENT |

Table of Contents

DIRECTOR NOMINEES (PROPOSAL 1)

We are requesting that the stockholders elect the nominees for director (listed below) to serve until the 2023 annual meeting2025 Annual Meeting of stockholdersStockholders and until their respective successors are duly elected and qualify.

Director Attendance

The Board of Directors recommends a vote FOR each nominee.

| | | | | | | | | | | Committee | | | | Experience |

| | | AGE | | DIRECTOR

SINCE | | INDEPENDENT | | AUDIT | | EXECUTIVE

COMPENSATION | | NOMINATING AND

CORPORATE

GOVERNANCE | | BUSINESS

LEADERSHIP | | REIT/ REAL

ESTATE | | PUBLIC

COMPANY

EXECUTIVE | | INVESTMENT/

FINANCIAL | | ENVIRONMENTAL,

SOCIAL

& GOVERNANCE | | LEGAL | | RISK

OVERSIGHT | | CYBER

SECURITY |

Milton

Cooper | | 93 | | 1991 | | | | | | | | | |  | |  | |  | |  | | | |  | | | | |

Philip E.

Coviello | | 78 | | 2008 | |  | |  | |  | |  | |  | |  | | | |  | |  | |  | | | | |

Conor C.

Flynn | | 41 | | 2016 | | | | | | | | | |  | |  | |  | |  | |  | | | | | | |

Frank

Lourenso | | 81 | | 1991 | |  | |  | |  | |  | |  | |  | |  | |  | | | | | |  | |  |

Henry

Moniz | | 57 | | 2021 | |  | |  | |  | |  | |  | | | |  | |  | |  | |  | |  | |  |

Mary

Hogan

Preusse | | 53 | | 2017 | |  | |  | |  | |  | |  | |  | | | |  | |  | | | | | | |

Valerie

Richardson | | 63 | | 2018 | |  | |  | |  | |  | |  | |  | |  | |  | | | |  | | | | |

Richard B.

Saltzman | | 65 | | 2003 | |  | |  | |  | |  | |  | |  | |  | |  | |  | | | |  | | |

Member

Member  Chair

Chair

Attendance:met seven times in 2023. During 2021,2023, each current director attended 100% of the aggregate of the total meetings of the Board and Board committees on which such person served.

The Company encourages directors to attend each annual meeting of stockholders, and all of the directors were in attendance at the 2023 Annual Meeting of Stockholders, which was held online.

Director Continuing Education

The Company maintains a program of continuing education for directors. In 2023, directors participated in customized Company-sponsored sessions on business-related topics, corporate governance matters, SEC rule changes, and other current topics such as ESG, DEI, ethical conduct and cybersecurity, including issues applicable to particular committees of the Board of Directors. These sessions included detailed presentations on which such director served.these matters and discussions on each of the covered topics.

| 6 | | Kimco Realty Corporation 2022 PROXY STATEMENT | 5kimcorealty.com |

Table of Contents

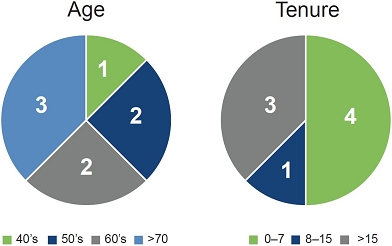

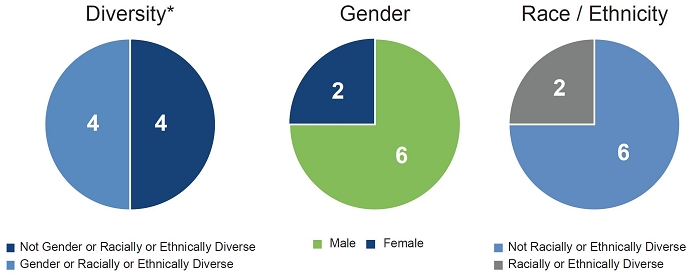

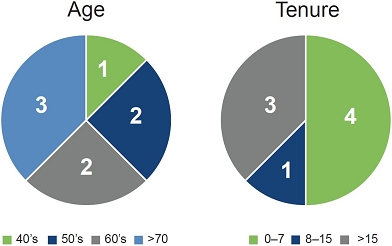

BOARD COMPOSITION

Stock Ownership Guidelines

The following charts showCompany has stock ownership guidelines that require each director and NEO to own shares of our common stock with a value equal to a certain multiple of his or her annual retainer or base salary. Equity interests that count towards the compositionsatisfaction of the eight director nominees by age, tenure, genderownership guidelines include shares owned outright, shares jointly owned, restricted shares and racial or ethnic diversity. More information about our process for evaluatingshares held in a 401(k)-retirement plan. Directors and NEOs have five years from the compositiondate they become a member of the Board of Directors or begin to serve in an officer role listed below to meet the ownership levels. All of our directors and NEOs are currently in compliance with the stock ownership requirements.

| Covered Person | Multiple Of Salary / Retainer |

| Executive Chairman | 5x |

| Non-Employee Director | 5x |

| Chief Executive Officer | 5x |

| President | 3x |

| Chief Operating Officer | 3x |

| Chief Financial Officer | 2x |

The Company also has a stock retention requirement for directors and NEOs. Any director or NEO who has not achieved the applicable stock ownership threshold must hold all net-settled shares (after payment of withholding taxes, transaction costs and the role of diversity in recommending candidatesexercise price for a director position can be found on page 27.options, as applicable) until he or she meets the applicable stock ownership threshold.

* The four Board members identified as diverse do not overlap in either gender diversityNo Hedging or race / ethnicity diversity.

6 | Kimco Realty Corporation 2022 PROXY STATEMENT |

Table of Contents

CORPORATE GOVERNANCE HIGHLIGHTS

INDEPENDENCE

We have an Executive Compensation Committee that is 100% independent. The Executive Compensation Committee engages its own compensation consultant and affirms each year that the consultant has no conflicts of interest and is independent.

NO HEDGING OR PLEDGING TRANSACTIONSPledging Transactions

We have a policy prohibiting all directors and named executive officers (“NEOs”)NEOs from engaging in any hedging transactions with respect to equity securities of the Company held by them, which includes the purchase of any financial instrument (including prepaid variable forward contracts, equity swaps, and collars) designed to hedge or offset any decrease in the market value of our equity securities. We also have a policy that prohibits directors and NEOs from using shares of our common stock, par value $0.01 per share (“Common Stock”), in any pledging transactions.

COMPENSATION CLAWBACK POLICYClawback Policy

We may seek repaymentThe Company has adopted a compensation recovery policy as required by Rule 10D-1 under the Securities Exchange Act of cash1934, as amended, and equity incentivethe corresponding listing standards of the New York Stock Exchange. This policy provides for the mandatory recovery (subject to limited exceptions) from current and former officers of incentive-based compensation paidthat was erroneously received during the three years preceding the date that the Company is required to NEOsprepare an accounting restatement. The amount required to be recovered is the excess of the amount of incentive-based compensation received over the amount that otherwise would have been received had it been determined based on the restated financial measure.

Board Membership

The Nominating and Corporate Governance Committee assists the Board of Directors in establishing criteria and qualifications for potential Board members. The committee identifies individuals who meet such criteria and qualifications to become Board members and recommends to the Board such individuals as potential nominees for election to the Board. In addition, after consideration of the experience and qualifications matrix set forth on page 11 and other needs of the Board, the Nominating and Corporate Governance Committee seeks competencies, attributes, skills and experience that will complement and enhance the Board’s existing make-up, while taking into account expected retirements, to best facilitate Board succession, transition and effectiveness. The Nominating and Corporate Governance Committee evaluates each individual in the event of a material misstatementcontext of the Company’s financial results whereBoard as a whole, to recommend a group that can best continue the success of our Company.

Risk Oversight

Our Board of Directors oversees an NEO engaged in actual fraud or willful unlawful misconduct that materially contributedenterprise-wide approach to risk management designed to support the needachievement of organizational objectives, including strategic objectives, to restateimprove long-term organizational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the Company’s financial results.

STOCK OWNERSHIP GUIDELINES

We have stock ownership guidelinesrisks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. Management is responsible for establishing our directorsbusiness strategy, identifying and NEOsassessing the related risks and a stock retention requirement for directorsestablishing appropriate risk management practices. Our Board of Directors reviews our business strategy and NEOs who have not achieved the applicable stock ownership level. As of December 31, 2021, eachmanagement’s assessment of the directorsrelated risk and NEOs (other than Mr. Moniz) satisfied his or her individual stock ownership requirement. Mr. Moniz becamediscusses with management the appropriate level of risk for the Company. Our Board of Directors administers its risk oversight function with respect to our operating risk as a directorwhole and meets with management at least quarterly to receive updates with respect to our operations, business strategies and the monitoring of the Company on January 12, 2021 and has until January 12, 2026 to meet the required ownership levels under the current stock ownership guidelines. See page 24 for a detailed discussion of our stock ownership guidelines.

EXECUTIVE SEVERANCE PLAN

We maintain an executive severance plan with a “double trigger” change in control arrangement that covers certain of our NEOs. The executive severance plan does not provide for any gross-up payments for taxes.

STOCKHOLDER ENGAGEMENT

related risks. The Board of Directors believes that accountability to stockholders is a mark of good corporate governance and is criticalalso delegates oversight to the Company’s success. The Company regularly communicates with its stockholders throughout the year to better understand their views on a range of topicsAudit, Executive Compensation and to provide perspective on the Company’s environmental, socialNominating and governance (“ESG”) policies and practices.

During 2021, the Company met with approximately 48% of its top 50 stockholders (representing approximately 31%Corporate Governance Committees of the outstanding sharesBoard, for example, the Audit Committee is responsible for enterprise risk management. The risk oversight responsibilities of our Common Stock). Topicsthe committees of the Board are discussed included, but were not limited to, our organizational strategy, financial and operating performance, board composition and structure, executive compensation program and emissions reduction, climate change, and diversity, equity and inclusion (“DE&I”) initiatives. We solicited feedback from stockholders on these subjects and shared this dialogue with ourfurther in “Committees of the Board of Directors.Directors” below. The Board believes the leadership structure described in “Board Leadership Structure” above facilitates the Board’s oversight of risk management because it allows the Board, with leadership from the Lead Independent Director and working through its committees, to proactively participate in the oversight of management’s actions.

Kimco Realty Corporation 2022 PROXY STATEMENTkimcorealty.com | 2024 Proxy Statement | | 7 |

TableCommittees of ContentsThe Board of Directors

BEST PRACTICE CORPORATE GOVERNANCE FEATURES

Audit Committee

WHAT WE DOCommittee Members | Key Responsibilities |

Richard B. Saltzman, Chair*

Philip E. Coviello

Frank Lourenso

Henry Moniz

Mary Hogan Preusse

Valerie Richardson Number of meetings in fiscal year

2023: 6 *Richard B. Saltzman was appointed as Chair in March 2024; Philip E. Coviello previously served as Chair. The Board has determined that each member of the Audit Committee is independent within the meaning of the Company’s independence standards and applicable listing standards of the NYSE. The Board has determined that each member of the Audit Committee is an audit committee financial expert in accordance with Item 407(d)(5) of Regulation S-K. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the Audit Committee Charter is available on the Company’s website located at www.kimcorealty.com. | DO maintain majority voting• Assists the Board in its oversight and financial risk assessment of: • the integrity of our financial statements • our accounting and reporting processes and internal controls • REIT and other tax compliance • our internal audit functions • our cybersecurity program • Selects, engages and reviews the independence and performance of our internal auditors and external registered public accounting firm • Assists the Board of Directors in fulfilling its oversight responsibility with respect to compliance with legal and regulatory requirements, including matters related to the Company’s financial statements • Has the ultimate authority and responsibility to select, evaluate, terminate and replace our independent registered public accounting firm • Enterprise risk management • Oversees risk and compliance related to the Company’s cybersecurity program, such as governance, policies and procedures and cyber incident response. • Approves the Audit Committee Report as shown on page 47. The report further details the Audit Committee’s responsibilities Each year, management and the Company’s internal auditors prepare an enterprise risk assessment matrix (“ERM”) that is reviewed and approved by the Audit Committee. The Audit Committee meets with management quarterly and receives regular reports from management, independent auditors and legal advisors regarding the Company’s assessment of risks including those related to our financial reporting function and those addressed in the ERM. In addition, the Audit Committee receives a risk and internal controls assessment report from the Company’s internal auditors on at least an annual basis and more frequently as appropriate. There were no material internal control deficiencies. The Audit Committee reports regularly to the Board of Directors. The Board of Directors and Audit Committee focus on the Company’s general risk management strategy, the ERM, and also ensure that risks undertaken by the Company are consistent with the business strategies approved by the Board of Directors. While the Board of Directors oversees the Company’s risk management, management is responsible for the electionday-to-day risk management processes and reports directly to both the Board of directorsDirectors and Audit Committee on a regular basis and more frequently as appropriate. The Board of Directors believes this division of responsibilities is an effective approach for addressing the risks facing the Company. Additional Risk Oversight Oversees financial, credit and liquidity risk by working with our treasury function to evaluate elements of financial and credit risk and advise on our financial strategy, capital structure and long-term liquidity needs, and the implementation of risk mitigating strategies. Individuals who supervise day-to-day risk in uncontested elections this area have direct access to the Board, and our Chief Financial Officer meets regularly with our Audit Committee to discuss and advise on elements of risks related to our credit risk.Reviews and monitors our compliance programs, including the whistleblower program and whistleblower helpline with respect to financial reporting and other matters. The Audit Committee also oversees risk by working with management to adopt and to review annually, or on an as needed basis, a Code of Conduct designed to support the highest standards of business ethics. |

| |

DO 8provide for annual election | | Kimco Realty | kimcorealty.com |

Executive Compensation Committee

| Committee Members | Key Responsibilities |

| DO align pay and performance with a significant majorityValerie Richardson, Chair

Philip E. Coviello

Frank Lourenso

Henry Moniz

Mary Hogan Preusse

Richard B. Saltzman Number of total compensation linked to the achievementmeetings in fiscal year 2023: 5 The Board has determined that each member of a balanced mix of Company and individual performance criteria tied to operational and strategic objectives established at the beginning of the performance period by the Executive Compensation Committee |

| DO deliver a substantial portion is independent within the meaning of the valueCompany’s independence standards and applicable listing standards of equity awards in performance shares—if our total stockholder return for a performance period is less than the minimum threshold level, no shares are earned or issued with respect to the performance period |

| DO maintain rigorous stock ownership guidelines for directors and NEOs |

| DO maintain a clawback policy |

| DO conduct annual assessments of compensation at risk |

| DO provide stockholders the right to amend the Bylaws |

| DO have anNYSE.The Executive Compensation Committee comprised solelyoperates under a written charter adopted by the Board of independentDirectors. A copy of the Executive Compensation Committee Charter is available on the Company’s website located at www.kimcorealty.com. | • Establishes and oversees our executive compensation and benefits programs • Approves compensation arrangements for senior management, including metric setting and annual incentive and long-term compensation • Evaluates our Executive Chairman and CEO’s performance • Reviews senior management leadership, performance, development and succession planning • Oversees our stock ownership policy • Reviews the compensation of our non-employee directors |

| DO retain• Administers the Company’s Clawback Policy • Oversees risk management by participating in the creation of compensation structures that create incentives to support an appropriate level of risk-taking behavior consistent with the Company’s business strategy and stockholder interests. The Executive Compensation Committee has retained an independent compensation consultant, that reports directly to the Executive Compensation Committee andPay Governance LLC (“Pay Governance”), which performs no other services for the Company other than executive compensation consulting services. |

Nominating & Corporate Governance Committee

| Committee Members | Key Responsibilities |

| DO provide capsMary Hogan Preusse, Chair

Philip E. Coviello

Frank Lourenso

Henry Moniz

Valerie Richardson

Richard B. Saltzman Number of meetings in fiscal year 2023: 5 The Board has determined that each member of the Nominating & Corporate Governance Committee is independent within annual and long-term incentive plan awards |

| DO provide continuing education for our Board |

| DO have an annual offsite strategic review by the Board with management |

| DO have an Environmental, Social and Governance (“ESG”) Steering Committee comprised of employee representatives throughout the Company to plan and coordinate the executionmeaning of the Company’s ESG program |

| DO haveindependence standards and applicable listing standards of the NYSE.The Nominating and Corporate Governance Committee that reviewsoperates under a written charter adopted by the Board of Directors. A copy of the Nominating and monitorsCorporate Governance Committee Charter is available on the developmentCompany’s website located at www.kimcorealty.com. | • Oversees governance related risks by working with management to establish corporate governance guidelines, including the leadership structure of the Board and membership on committees of the Board • Reviews ESG related policies and initiatives with management quarterly, or on an as needed basis, and oversees the progress and implementation of the goals established for the Company’s ESG program |

| DO require any search firm• Assists our Board in establishing criteria and qualifications for potential Board members • Identifies and recruits high-quality individuals to includebecome members of our Board and recommends director nominees to the Board, placing emphasis on the importance of a diverse board and determining director independence • Leads the Board in its initial list of board candidates, qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin, gender, and sexual orientation |

WHAT WE DON’T DO |

| NO compensation or incentives that encourage risk-taking reasonably likely to have a material adverse effect on the Company |

| NO tax gross-ups for any executive officers |

| NO “single-trigger” change in control cash or equity payments |

| NO re-pricing or buyouts of underwater stock options |

| NO hedging or pledging transactions involving our securities |

| NO guarantees of cash incentive compensation or of equity grants |

| NO employment contracts with executive officers |

| NO supermajority voting requirements |

| NO stockholder rights plan (i.e., no “poison pill”) |

8 | Kimco Realty Corporation 2022 PROXY STATEMENT |

Table of Contents

ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION (PROPOSAL 2)

We are requesting that the stockholders approve, on a non-binding, advisory basis, the compensation of the NEOs as described in this Proxy Statement. The Board of Directors recommends a vote FOR Proposal 2 as it believes that the 2021 compensation decisions are consistent with key objectives of Kimco Realty’s executive compensation program: to promote long-term performance through emphasis on the individual performances and achievements of our executive officers, commensurate with our business results, and to successfully execute our strategy to be the premier owner and operator of open-air, grocery-anchored shopping centers and mixed-use assets in the U.S. This proposal was supported by over 98% of the votes cast (which excludes abstentions and broker non-votes) in 2021. Please see the Compensation Discussion and Analysis, Summary Compensation Table for 2021 and other compensation tables and disclosures beginning on page 32 of this Proxy Statement for a full discussion of our executive compensation.

2021 PERFORMANCE HIGHLIGHTS

$818.6M | $706.8M | +149 |

NET INCOME AVAILABLE

TO THE COMPANY’S

COMMON

SHAREHOLDERS

| FUNDS FROM

OPERATIONS

AVAILABLE TO THE

COMPANY’S COMMON

SHAREHOLDERS (“FFO”)* | PROPERTIES ADDED

THROUGH THE

STRATEGIC MERGER WITH

WEINGARTEN REALTY

INVESTORS |

8.7MSF | $2.3B | $1.2B |

TOTAL PRO-RATA

LEASING SQUARE

FOOTAGE VOLUME | TOTAL IMMEDIATE

LIQUIDITY, INCLUDING

FULL $2.0B AVAILABLE ON

UNSECURED REVOLVING

CREDIT FACILITY | REMAINING OWNERSHIP

INTEREST IN ALBERTSONS

(NYSE: ACI)** |

* See Annex A starting on page 58 for the definition of FFO and a non-GAAP reconciliation of net income to FFO.

** Ownership interest in Albertsons Companies Inc. (“Albertsons”) (NYSE: ACI), based upon closing price of ACI stock on December 31, 2021 at $30.19 per share.

Kimco Realty Corporation 2022 PROXY STATEMENT | 9 |

Table of Contents

2021 fiscal year highlights: |

| | 2021 HIGHLIGHTS:

● In August, completed the strategic merger with Weingarten Realty Investors (“the Merger”) further expanding Kimco Realty’s grocery-anchored portfolio and its presence in fast growing Sun Belt markets with the addition of 149 properties totaling 23.5 million square feet of gross leasable area (“GLA”).

● Achieved total pro-rata occupancy of 94.4% as of December 31, 2021, representing a 50 basis-point increase year-over-year.

● Ended the year with pro-rata anchor occupancy at 97.1%, up 40 basis points year-over-year and small shop occupancy at 87.7%, an increase of 160 basis points year-over-year.

● Executed 1,540 leases totaling over 8.7 million square feet of GLA in the Company’s consolidated and joint venture operating portfolios during 2021. Achieved pro-rata rental rate leasing spreads of 6.5% with rental rates for new leases up 8.7% and renewals/options up 5.9%.

● As of December 31, 2021, 80%annual assessment of the Company’s pro-rata annualized base rent (“ABR”) came from grocery-anchored shopping centers, with a goal of reaching 85% of ABR by 2025.

|

| | 2021 HIGHLIGHTS:Board’s performance

● Produced net income available to the Company’s common shareholders of $818.6 million, or $1.60 per diluted share,• Reviews committee membership and recommends nominees for the year ended December 31, 2021 compared to $975.4 million, or $2.25 per diluted share, for the year ended December 31, 2020.

● Achieved FFO of $1.38 per diluted share for the year ended December 31, 2021, compared to $1.17 per diluted share for the year ended December 31, 2020.

● Recognized 8.8% growth in same property Net Operating Income (“NOI”)* for the year ended December 31, 2021, due to the strong recovery in tenant health resulting in improved credit loss.

● $2.3 billion in immediate liquidity, including full $2.0 billion available on the Company’s unsecured revolving credit facility.

● In the fourth quarter, achieved Look-Through Net Debt to EBITDA* which includes the pro-rata portion of joint venture debt and perpetual preferred stock outstanding of 6.6x, the lowest level reported since the Company began disclosing this metric.

● Issued $500 million of 2.250% notes due 2031, which represents the lowest coupon for ten-year unsecured notes issued by the Company in its history.

● Exceeded the upper endeach committee of the annualized cost synergy ranges of $35 million to $38 million on a GAAP basis and $31 million to $34 million on a cash basis in connection with the Merger.

|

| | 2021 HIGHLIGHTS:

● Raised our 2025 target for multi-family unit entitlements from 10,000 to 12,000 units. As of December 31, 2021, the Company has approximately 6,000 entitlements for apartment units, 900 for hotel keys and 909,000 square feet for office space.

● Completed 12 redevelopment projects during 2021. All 12 projects totaled $44.8 million with a blended return of 12%.

● Committed $176.2 million through our structured investment program.

● Acquired the remaining interest in nine grocery-anchored properties from the Company’s existing joint venture partners and formed a new joint venture partnership with Blackstone (“BREIT”) under which both Kimco Realty and BREIT will own 50% of a portfolio of six Publix-anchored Sun Belt shopping centers.

● Ended the year with the Company’s investment in Albertsons Companies Inc. (NYSE: ACI) common stock valued at over $1.2 billion.Board

|

*kimcorealty.com | See Annex A starting on page 58 for the respective definitions and non-GAAP reconciliations.2024 Proxy Statement | | 9 |

10 | Kimco Realty Corporation 2022 PROXY STATEMENT | |

Table of Contents

2021 COMPENSATION AWARDED

The table below summarizes the total compensation awarded to each NEO (see pages 32 through 51 of this Proxy Statement for further detail) with respect to 2021.

| NAME | SALARY

($) | STOCK

AWARDS

($) | NON-EQUITY

INCENTIVE PLAN

COMPENSATION

($) | ALL OTHER

COMPENSATION

($) | TOTAL

($) |

| Milton Cooper | 750,000 | 1,836,355 | 1,600,000 | 3,702 | 4,190,057 |

| Conor C. Flynn | 1,000,000 | 5,963,854 | 3,500,000 | 24,284 | 10,488,138 |

| Ross Cooper | 700,000 | 1,848,807 | 1,350,000 | 27,337 | 3,926,144 |

| Glenn G. Cohen | 675,000 | 1,848,807 | 1,300,000 | 24,094 | 3,847,901 |

| David Jamieson | 675,000 | 1,848,807 | 1,300,000 | 13,417 | 3,837,224 |

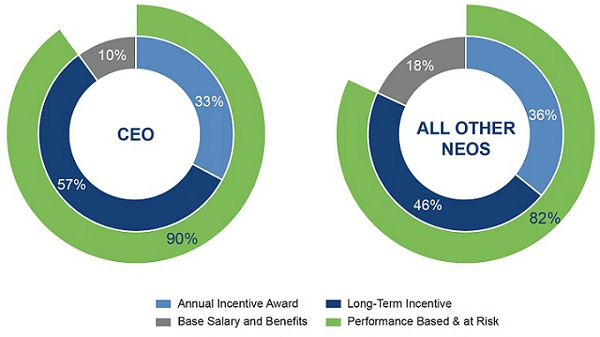

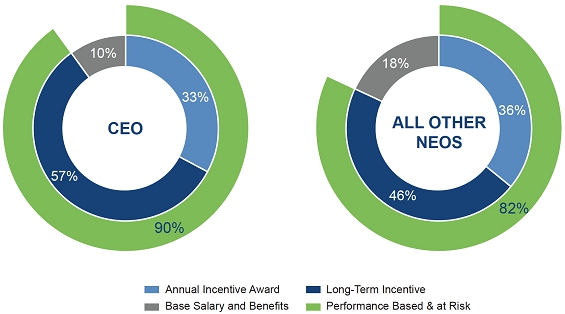

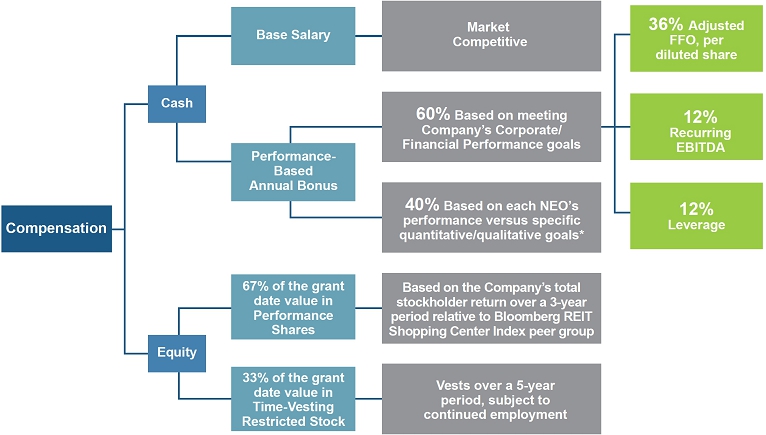

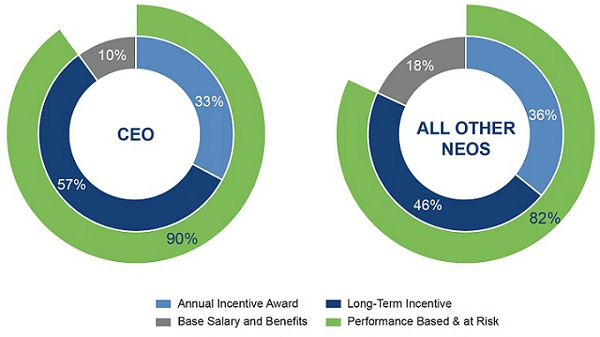

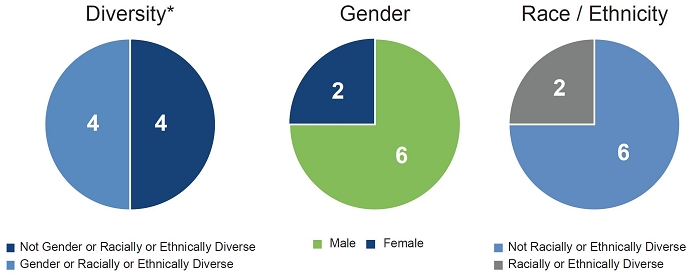

SIGNIFICANT PORTION OF PAY IS PERFORMANCE-BASED & AT RISK*

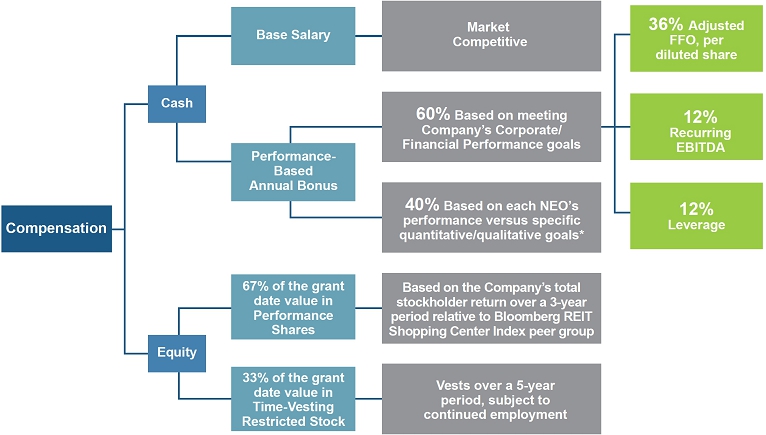

Consistent with our executive compensation program, the significant majority of the total compensation awarded with respect to 2021 for our CEO, Mr. Flynn,Certain Relationships and all other NEOs was performance-based, commensurate with business results, and “at risk” unless such business results were achieved, as illustrated below. See page 37 for a discussion of the components of our executive compensation program.

* Amounts are based on the Summary Compensation Table for 2021 on page 43, excluding the portion of Mr. Milton Cooper’s 2020 bonus that was awarded in 2021 in the form of a stock award.

Kimco Realty Corporation 2022 PROXY STATEMENT | 11 |

Table of Contents

ENVIRONMENTAL, SOCIAL AND GOVERNANCE PROGRAM

Related Transactions

The Company reviews all relationships and transactions in which the Company and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. Our current written policies and procedures for review, approval or ratification of relationships or transactions with related persons are set forth in our:

| • | Code of Conduct; |

| • | Corporate Governance Guidelines; |

| • | Nominating and Corporate Governance Committee Charter; and |

| • | Audit Committee Charter. |

Our Code of Conduct applies to all of our directors and employees. Review and approval of potential conflicts of interest involving our directors, executive officers or other principal officers may only be conducted by our Board of Directors. A copy of the Company’s Code of Conduct is focused on building a thrivingavailable through the Investors/Governance/Governance Documents section of the Company’s website located at www. kimcorealty.com and viable business, oneis available in print to any stockholder who requests it.

Our Corporate Governance Guidelines provide that succeeds by delivering long-term value for our stockholders. The Company’s ESG program is aligned with its core business strategy of creating destinations for everyday living that inspire a sense of community and deliver value to our many stakeholders.

Thethe Nominating and Corporate Governance Committee will review annually the relationships that each director has with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company), in the course of making independence determinations under the Company’s categorical independence standards for directors and the NYSE listing standards. Directors are expected to avoid any action, position or interest that conflicts with the interests of the Company or gives the appearance of a conflict. If an actual or potential conflict of interest develops, the director should immediately report the matter to the Executive Chairman of the Board of Directors. Any significant conflict must be resolved, or the director should resign. If a director has a personal interest in a matter before the Board of Directors, the director will disclose the interest to the Board of Directors, excuse himself or herself from discussion on the matter and not vote on the matter. The Corporate Governance Guidelines further provide that the Board of Directors is responsible for reviewing and, monitoring (i) the developmentwhere appropriate, approving major changes in and implementation of goals established for the ESG program, (ii) the development of metrics to gauge progress toward the achievement of those goals, and (iii)determinations under the Company’s progress against those goals. David Jamieson, the Company’s Executive Vice PresidentCorporate Governance Guidelines, Code of Conduct and Chief Operating Officer, is responsible for overseeing the implementation of program initiatives on a daily basis, and Conor Flynn, the Company’s CEO, receives regular updates on program progress and oversees the implementation of all enterprise initiatives in this area.other Company policies. The individual component of each of Mr. Jamieson’s and Mr. Flynn’s 2021 annual bonus includes an assessment of his individual contributions towards the ESG program. In 2021, the Company hired a Senior Director of ESG who is fully dedicated to leading and driving ESG strategies, programs, and initiatives across the organization. Additionally, the Company has an established ESG Steering Committee, a cross-functional and diverse committee comprised of employee representatives throughout the Company,Corporate Governance Guidelines also provide that plans and coordinates the execution of the ESG program. The ESG Steering Committee meets monthly and is responsible for regularly reviewing and recommending strategic priorities and goals to management and reporting to the Board of Directors on a quarterly basis.

12 | Kimco Realty Corporation 2022 PROXY STATEMENT |

Tablehas the responsibility to ensure that the Company’s business is conducted with the highest standards of Contentsethical conduct and in conformity with applicable laws and regulations.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE PROGRAM

The Company has establishedPursuant to the following five pillarsAudit Committee Charter and the Audit Committee’s policy regarding related-person transactions, the Audit Committee reviews and approves or ratifies related-person transactions that are required to be disclosed as well as all other related-person transactions identified to the Audit Committee by management or the Company’s internal audit function. In the course of its ESG program,review and approval or ratification of a related-party transaction for which outlinedisclosure is required, the strategic priorities in this space. This framework was enhanced in February of 2021 with 16 newly defined, comprehensive ESG goals. These goals expand upon our commitment with clear targets in each pillar:

ESG PILLARS | | | COMPREHENSIVE ESG GOALS |

| | | |

Communicate Openly with Our Stakeholders: Maintain regular engagement with key stakeholder audiences, reporting accurate information on issues of relevance to those audiences. | | | ● Regularly engage with key stakeholders and annually report relevant ESG Information in alignment with leading disclosure standards

|

| | | |

Embrace the Future of Retail: Foster a sense of place at our shopping centers, creating people-centered properties that are more convenient and accessible. | | | ● Construct or entitle at least 12,000 residential units by 2025, as part of our effort to create quality mixed-use live-work-play environments

● Establish Curbside Pickup infrastructure at 100% of all qualified locations by 2025

● Establish dedicated space for the activation of outside common areas at 20% of properties by 2030

● Establish low-carbon transportation infrastructure at 25% of properties by 2025

|

| | | |

Engage Our Tenants and Communities: Help our tenants succeed and be a positive presence in the communities where we operate and live. | | | ● Maintain an average tenant satisfaction rate of at least 80%

● Give $1.0 million annually in cash and in-kind contributions to support small businesses and charitable causes in the communities in which we operate

|

| | | |

Lead in Operations and Resiliency: Maximize efficiency of operations and protect our assets from disruption by climate, security and other disruptions. | | | ● Invest $500.0 million in eligible Green Bond projects by 2030

● Reduce Scope 1 and 2 GHG emissions by 30% from 2018 to 2030 and achieve net zero by 2050. Partner with tenants to quantify and reduce emissions, establishing a Scope 3 goal by 2025

● Improve common area water efficiency at properties by 20% by 2025

● Achieve 50% waste diversion rate for waste-to-landfill in our corporate offices by 2025

● Establish a comprehensive Vendor Business Practices Policy and expand supply chain reporting

|

| | | |

Foster an Engaged, Inclusive andEthical Team: Cultivate high levels of employee satisfaction and improve all levels of the organization. | | | ● Maintain an average employee satisfaction rate of at least 90%

● Increase the proportion of diverse employees in management to 60% by 2030, by developing programs to recruit, develop and retain diverse talent and promoting a culture of inclusion

● Provide 100% of employees with individual development opportunities and maintain a voluntary turnover rate below 10% annually

● Achieve 75% participation in employee well -being programs annually

|

Kimco Realty Corporation 2022 PROXY STATEMENT | 13 |

Table of Contents

ENVIRONMENTAL, SOCIAL AND GOVERNANCE PROGRAM

2021 ESG HIGHLIGHTS

● | Recognized by the Global Real Estate Sustainability Benchmark, earning the distinguished Green Star designation for the eighth consecutive year and placing first in our peer group (US Retail – Strip Malls). |

● | Included in the Dow Jones Sustainability North America Index for the seventh consecutive year. |

● | Included in the Russel “FTSE4Good” Index Series. |

● | Set 16 comprehensive, newly defined ESG goals, including a Science Based Target for Scope 1 and 2 GHG reduction (certified by SBTi), and a target to increase diversity in management. |

● | Awarded the “Great Place to Work” certification four years consecutively, honoring the culture the Company provides to employees on a daily basis. |

● | Hired the Senior Director of ESG, a fully dedicated resource focused on driving ESG strategy, programs, and initiatives. |

● | Published a comprehensive, stand-alone ESG presentation on our website focused on engaging our investors and other stakeholders. |

● | Launched two sub-committees to the ESG Steering Committee; the Communications Sub-committee is focused on cross-audience communications, and the ESG Capital Improvements Sub-committee is focused on capital improvement planning to help the Company achieve Science-Based Targets and efficiency goals. |

● | Launched four KIMunity Councils in addition to the Company’s existing Diversity, Equity, and Inclusion Council, focused on achieving the Company’s ESG goals surrounding Sustainability, Giving, Wellness, and Tenant Engagement. |

● | Regularly engaged with leadership team and Board of Directors on ESG topics, programs, and progress. |

● | Conducted regular interactive trainings, so employees have clarity with respect to our values and culture. |

● | Acquired feedback from our associates through third-party, anonymous survey tools to learn how we can be even better, and several of our programs today are a result of the valuable input received. |

| | ESG Disclosure Roadmap | |

| | The Company is committed to having best-in-class ESG disclosure and has aligned its annual reporting with standards from the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB) (now known as the Value Reporting Foundation) and Task Force on Climate-related Financial Disclosures (TCFD). The Company also discloses information on its EEO-1 Report that can be found on the Company’s website. ESG information of relevance to stakeholders including program governance, goals and performance can be found in three primary locations: | |

�� | |  | Annual Report/10-K

Summarizes ESG program priorities and material risk disclosures.

| |  | Proxy Statement

Summarizes corporate governance practices, including how the Board and management are engaged in ESG program strategy, governance and accountability.

| |  | Responsibility Report

Based on the Global Reporting Initiative (GRI) standard, summarizes environmental and social performance.

| |

| | | | | | | | | | |

| (1) | The information contained in our Corporate Responsibility Report does not constitute part of this Proxy Statement. |

14 | Kimco Realty Corporation 2022 PROXY STATEMENT |

Table of Contents

RATIFICATION OF INDEPENDENT ACCOUNTANTS (PROPOSAL 3)

We are requesting thatAudit Committee routinely considers: the stockholders ratify the appointmentnature of the Company’s independent registered public accounting firm forrelated-person’s interest in the year ending December 31, 2022. The Board of Directors recommends a vote FORtransaction; the ratificationmaterial terms of the appointment of PricewaterhouseCoopers LLP astransaction; the Company’s independent registered public accounting firm for the year ending December 31, 2022.

| TYPE OF FEES | 2021 | 2020 |

| Audit Fees(1) | $3,091,723 | $1,952,450 |

| Audit-Related Fees(2) | $65,000 | $152,550 |

| Tax Fees | - | - |

| All Other Fees(3) | $900 | $2,700 |

| Total | $3,157,623 | $2,107,700 |

(1) Audit fees include all fees for services in connection with (i) the annual integrated auditimportance of the Company’s fiscal 2021 and 2020 financial statements and internal control over financial reporting included in its annual reports on Form 10-K, (ii) the review of the financial statements included in the Company’s quarterly reports on Form 10-Q, (iii) as applicable, the consents and other required letters issued in connection with debt and equity offerings and the filing of the Company’s shelf registration statement, current reports on Form 8-K and proxy statements during 2021 and 2020, (iv) the Merger, (v) ongoing consultations regarding accounting for new transactions and pronouncements and (vi) out of pocket expenses.

(2) Audit-related fees for the year 2021 consisted of fees billed for audit and testing procedures relatingtransaction to the green bond attestation report. Audit-related fees for the year 2020 consisted of fees billed for auditrelated person and testing procedures relating to the implementation of the Company’s new operating and accounting software system during 2020.

(3) All other fees consisted of fees billed for other products and services. The fees relate to a publication subscription service and software licensing for accounting and professional standards.

Kimco Realty Corporation 2022 PROXY STATEMENT | 15 |

Table of Contents

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS to be held on April 26, 2022